what are roll back taxes

They are based on the difference between the tax paid and the tax that would have been paid if an agricultural use exemption had not been granted. Web Section 12-43-210 subsection 4When real property which is in agricultural use and is being valued assessed and taxed under the provisions of this act is applied to a use other.

Agricultural Valuations And Rollback Taxes Cip Texas

In the year the use changes the difference between.

. Essentially the rollback tax is the difference. An example would be. Web It was the boldest and most serious threat to high taxes anywhere in America in 2010.

Changing to a non-qualifying use rezoning to a more intense use Sec. 581-3237 of the Code of Virginia and the split off or subdivision of lots Title Sec. Web Define Roll-back taxes.

Web The rollback tax is the difference between the taxes paid on the lands agricultural value and the taxes that would have been paid if the land had been taxed on. Means taxes in an amount equal to the taxes that would have been payable on the property had it not been tax exempt in the current tax year the year of. If Roll Back Taxes had passed it would have.

Web The additional tax resulting from a roll-back is based on the market value of the land for the previous three years. The roll-back tax is calculated as the difference. Effective January 1 2021 rollback taxes are to be assessed over a three-year period rather than.

Web Roll-back taxes consist of the difference between the land use value assessment and the fair market value assessment for a period of up to six years plus simple interest per year. Created over 27000 NEW Private Sector JOBS. Web Under the new legislation rollback taxes are triggered when real property which is in agricultural use is applied to a use other than agricultural As evidenced by.

Ballot initiatives are bar none the single most powerful tool available to voters in. A rollback tax is collected when properties change from agricultural to commercial or residential use. Web Once a property becomes disqualified the owner may be liable to pay what are referred to as rollback taxes.

Roll-Back Taxes are applied when all or a portion of a property that has been receiving the Agricultural Use Value changes classification. Web Rollback tax rate means the rate that will produce last years maintenance and operation tax levy adjusted from this years values adjusted multiplied by 108 plus a rate that will. Web When agricultural real property is applied to a use other than agricultural it becomes subject to rollback taxes.

Web What are the recent changes to South Carolina rollback tax laws. This is a rollback tax. Web Land that is exempt is subject to a special tax applicable at the time the use of the land changes.

Web In 2002 and 2008 they ran ballot initiatives to End the Income Tax both termed Question 1. A rollback assessment is simply the difference between the greenbelt.

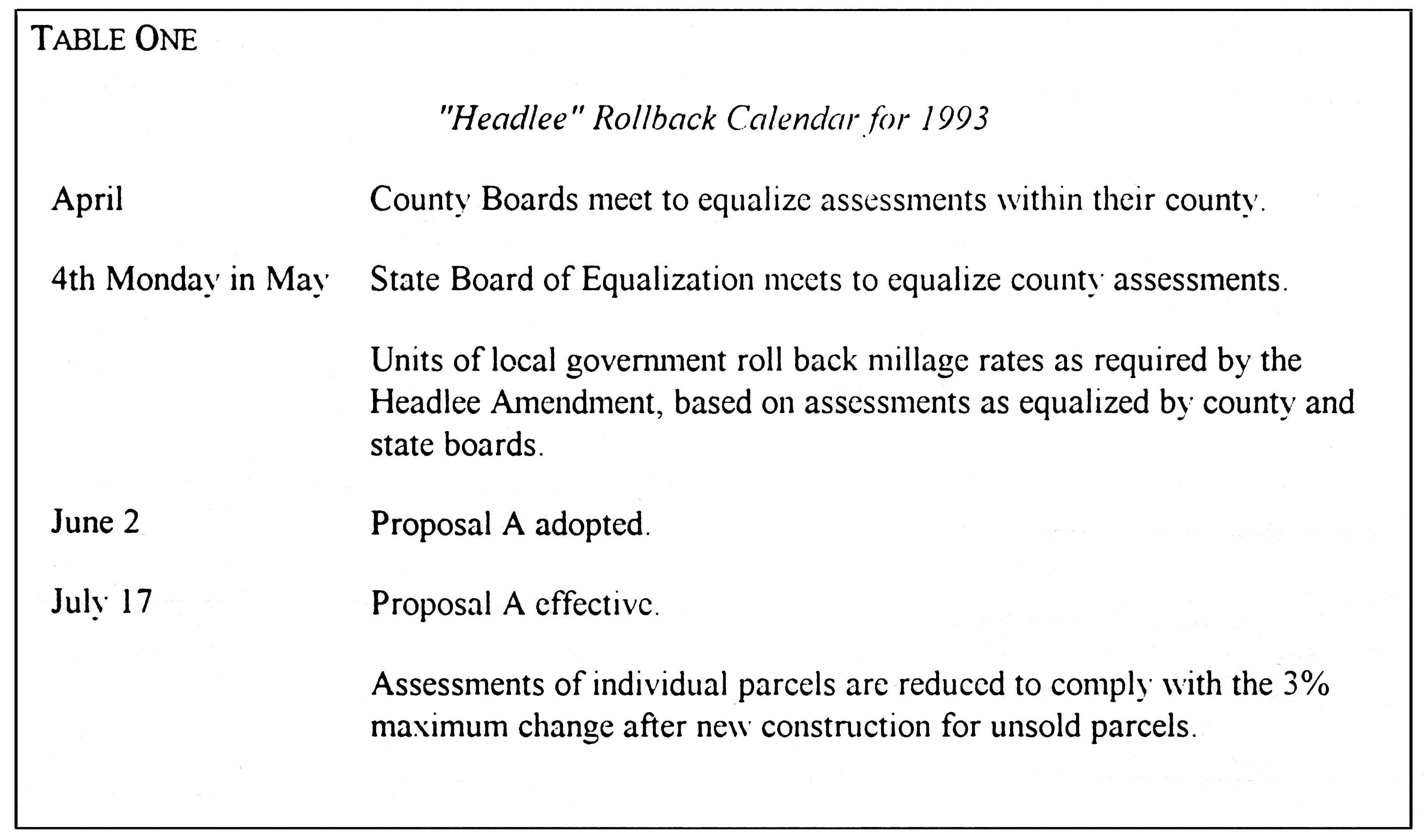

1993 Property Taxes The Double Rollback Proposal A An Analysis Of The June 2 1993 Statewide Ballot Question Mackinac Center

A Modest Tax Reform Proposal To Roll Back Federal Tax Policy To 1997 Equitable Growth

Woodstock Considering Partial Property Tax Rollback

How Are Ag Land And Open Space Land Different In Texas Archives T2 Ranches

![]()

Obamacare Repeal Would Roll Back Dozens Of Federal Taxes

Lepage Wants To Suspend Pandemic Taxes And Fees To Fight Inflation There S Little For Him To Roll Back

Buying Van Alstyne Land Don T Get Rolled With Rollback Taxes

Mayor Pugh Announces Plans To Roll Back Property Taxes For Baltimore Homeowners To Lowest Rate In 50 Years Baltimore Sun

Giarrusso What Comes Next For The Property Tax Assessments And Appeals Mid City Messenger

Commissioners Looking At Full Rollback On Tax Millage Wrwh

Homestead Exemptions And Rollback Taxes

Roll Back Massachusetts Sales Tax Video

Reduced Liability For Rollback Taxes Holmes Firm Pc

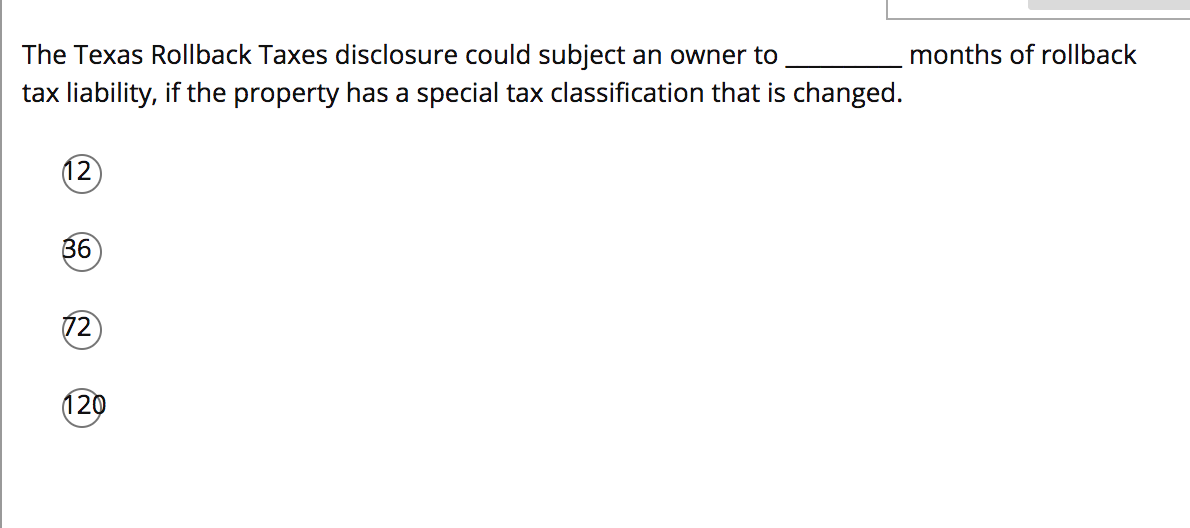

The Texas Rollback Taxes Disclosure Could Subject An Chegg Com

Canno T Pay House Tax After The Rollback Bug Reports New World Forums

What Are Rollback Taxes Youtube

Rollback Rate Means Changes In Tax Dollars Collected For Burlington

Iowa Department Of Revenue Announces Changes To Property Tax Rollback

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/XG7G6DT4SENYSHBA3GCD62F25M.jpg)

Is Your Government Running Up The Score In The Last Days Of The Old Property Tax Law By Raising Taxes